Tally Solutions

Who Should Issue an e-Invoice in GST?

Who Should Issue an e-Invoice in GST?

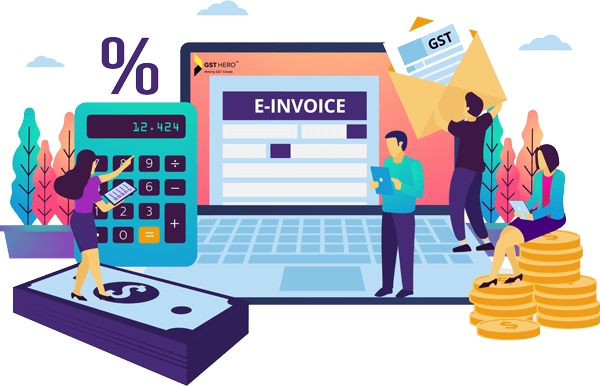

1 st October, 2020 will mark the introduction of e-invoice concept into the GST system. The GST Council has approved electronic invoicing in a phased manner which requires businesses to report B2B invoices to IRP (Invoice Registration Portal). In the Who Should Issue an e-Invoice in GST?

For the first time, the standard for invoicing is being introduced in the country, it is imperative for businesses to understand the fundamentals and get familiarize with the e-invoicing system. The e-invoicing concept being new, the most asked question is who should issue an e-invoice? Who Should Issue an e-Invoice in GST?

Let’s discuss and understand types of business who should issue an e-invoice?

Who should issue an e-invoice?

The notification giving effect to the requirements of e-invoicing was issued on 13th Dec 2019. Businesses who are required to issue e-invoice depends upon the aggregate annual turnover. Who Should Issue an e-Invoice in GST?

So, if your business is registered under GST, then you should check with the following table to ascertain requirement of issuing e-invoice.

|

e-Invoice Criteria |

Result |

Whether you are required to issue e-invoice? |

|

Is your aggregate turnover in excess of Rs. 500 Crore? |

Yes |

You have to issue an e-invoice for supply made by you |

|

Is turnover based on PAN India? |

Aggregate turnover should be calculated by taking all the supplies made under GSTNs bearing the same PAN across India

|

If turnover exceeds Rs. 500 crores under the same PAN, you have to issue an e-invoice |

|

Current or previous financial year turnover? |

As the notification states ‘aggregate turnover in a financial year’ indicates that the turnover to be considered here is not of the previous financial year but the current financial year.

|

This could lead to interpretation issues and an easier way to look at is to consider the previous year aggregate turnover to determine the e-invoice applicability. |

To summarize, if you are business whose aggregate turnover in the financial year exceeds 100 Crores, it’s mandatory to issue e-invoice for supplies made by you.

Now that we are clear with who is required to issue an e-invoice, the next question which comes to mind is on the transactions type covered under e-invoice. To make it more precise, what type of documents are covered under the e-invoice concept? Who Should Issue an e-Invoice in GST?

What type of documents are to be reported to GST system?

As the name suggests, an invoice issued by the supplier to the customer is a primary document covered under the e-invoice concept. Other than invoice, there are also other documents which are required to be reported to IRP by the creator of the document. The following are the list of documents covered under the ambit of e-invoice. Who Should Issue an e-Invoice in GST?

- Invoice by Supplier

- Credit Note by Supplier

- Debit Note by Supplier

- Any other document as notified

Overall, all such documents which have a repercussion on Input tax credit (ITC) are covered under e-invoice.

Will the invoice process change with the e-invoice concept?

It is believed that business can continue to generate their invoices through their existing accounting software, and they would not be required to generate any invoices on the GST Portal or any other portal for the being. But the fact is that an invoice will be valid only if it has IRN authenticated by the IRP.

To issue a valid invoice, the businesses would require to upload invoice data prepared using the accounting software on the IRP. After which the portal will generate an IRN (Invoice Reference Number) and this will form part of proof for all the documents that are generated for movement of goods from seller’s place to buyer’s place. Here, the accounting software you use will play a key role not only in generating GST compliant invoice but also to ensure you sail through the new mandate smoothly. Who Should Issue an e-Invoice in GST?

The accounting software you use should have a built-in capability to generate e-invoice data in the prescribed format and more importantly, seamlessly interacts with the IRP portal to complete the e-invoice process without the manual intervention. Who Should Issue an e-Invoice in GST?

CALL US FOR ANY QUERY WE ARE GLAD TO HELP YOU OUT @9811782542 & 9911721597

| Are you looking for faq on e invoicing cbic | ||||

| Are you looking for e invoice for exempted goods | ||||

| Are you looking for e invoicing turnover limit | ||||

| Are you looking for e-invoice schema | ||||

| Are you looking for gst e invoice for b2c | ||||

| Are you looking for sap e invoicing india | ||||

| Are you looking for iris e invoicing | ||||

| Are you looking fore invoice format released by gstn | ||||

| Are you looking fore invoice api integration system | ||||

| Are you looking for how to create e invoice in gst portal | ||||

| Are you looking fore tally | ||||

| Are you looking for gst new return forms | ||||

| Are you looking for new gst return in tally | ||||

| Are you looking for tally form | ||||