Tally Solutions

how to Multi GSTN Billing in Tally Prime Buy TDL

how to Multi GSTN Billing in Tally Prime Buy TDL

Managing Multiple GSTN in One Company using Tally ERP

The year 2017 gave rise to the Goods & Services Tax Network, popularly known as the GSTN. This tax was formed to support the Government pertaining to tax laws. It has helped several companies carry out paperless transactions. The IT industry along with GSTN has made possible safe digital calculations of taxes.

Key features of managing multiple GSTN in one company using Tally include:

- Maintains data of multiple branches within a single organisation

- Allows users to get GSTR 1, GSTR 2, GSTR 3B reports of different branches at a single place

- Reduces issues that occur during GSTR returns

-

- Aids planning of returns

- Assists in understanding the performance of different branches

- Easy maintenance

The add-on feature of Tally allows users to maintain multiple branches. Companies can have multiple branches in different states or in the same states.how to Multi GSTN Billing in Tally Prime Buy TDL Users can show multiple branch company while filing the GSTR of one company. The add-on feature works on Tally.ERP 9 6.4 & above. Users can upgrade to these versions to avail the benefits of GST filing. Tally.ERP 9 6.4 is the latest version that supports all features.https://dssoftweb.com/

It is advisable to take a back-up of company data before installing the add-on. This ensures all user data is intact. how to Multi GSTN Billing in Tally Prime Buy TDLCompanies store data in Tally ERP in a way t at it can be retrieved at any given point in the future. Once this is complete, follow the path:

Gateway of Tally > F12: Configure > Product & Features > F4: Manage Local TDL > Paste TDL Path for example: F:Tally.ERP9TDL File GST Multi Company.tcp

Once the company introduces the add-on feature, the next step is to activate it. Follow the path given below:

Gateway of Tally > F11: Features à Add-on Features > Set the option “Enable GST Multi Co Module” as “Yes”

Once the user clicks on “Yes” the multi co module gets activated.

Everything on the software is self-explanatory. When users click on accounting info, they can enter branch details. This would open a Branch window, in which, the name of the present branch, the parent branch, state and the individual GST number will be visible. Once the user enters branch details, click on Save to save the information for future use. This is known as GST Branch Master Creation.

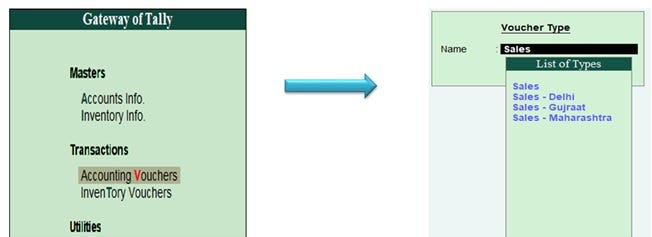

Once the branch is created, the next step is voucher type creation and configuration of branch wise purchase. Follow the path given below:

From Gateway of tally > Accounting Info > Voucher Type > Create > Enter Branch Details > Save

The next step is to create a branch wise purchase invoice. The gateway of Tally opens three main elements namely, Masters, Transactions and Utilities. The Masters element consists of accounts information and inventory information. how to Multi GSTN Billing in Tally Prime Buy TDL The Transactions element consists of accounting vouchers and inventory vouchers. In order to enter purchase details, users must choose the Transactions element. Users can choose either of the two options in the Transactions element. The types of vouchers would appear in the drop down list. Users can also see the type of voucher for different branches.https://onlineretailhub.in/