Tally Solutions

What| is| Profitability| Analysis?| Definition| and| Importance1.1

What is profitability analysis?

When a corporation is incepted, one among the only purposes of it’s to form profits. Basically, to earn quite you spend is what every business owner wants for his company. Thus, to assess the expansion of your business, careful study on profit is vital , which is pretty obvious. However, the nuances that secretly lie under various financial statements, will offer you the important picture of your company’s profits. What| is| Profitability| Analysis?| Definition| and| Importance

Analysing of the profits which is essentially the cash remaining from the capital after subtracting all the overhead costs, will assist you keep a track of your business’ performance. Profitability analysis allows companies to maximise their profit. Thus, leading to maximising the opportunities that business can cash in of, so as to continue growing in a particularly dynamic, competitive, and vibrant market. Profitability analysis helps businesses identify growth opportunities, fast/slow-moving stock items, market trends, etc, ultimately helping decision-makers see a more concrete picture of the corporate as an entire . What| is| Profitability| Analysis?| Definition| and| Importance

Importance of profitability analysis

While profitability analysis gives business owners a 360° view of your company’s profits, different ratios that derive profitability ratios have different roles to play. Let’s take a glance at the importance of those ratios:

Gross profit margin

It is a measure of the profit earned on sales which denotes the profit a part of the entire revenue earned, after deducting the prices of products sold (COGS). This report is extremely important because it covers the admin and office costs and also includes the dividends which are to be distributed to respective shareholders of the corporate . Higher the gross profit margin , the corporate are going to be more profitable. gross profit margin margin is additionally wont to assess the efficiency of cost management. So, if the ratio is low, the business owner can then identify these pain points and improve purchasing and production in terms of economy and effectiveness.

Net profit margin

It is the ultimate ratio that validates the general performance of a corporation . Any disturbances in other ratios will impact internet margin of profit ultimately, thus this report is taken into account together of the foremost important ratios. a coffee quick ratio would mean that sales are low during a particular period, eventually impacting internet margin of profit . This analysis will help investors to spot the cracks within the way they operate and take timely decisions to enhance the company’s performance. What| is| Profitability| Analysis?| Definition| and| Importance

Returns on equity

Returns on equity is that the percentage of the earnings, which shareholders get reciprocally for the investments made towards the corporate . Higher the ROE, higher are going to be the dividends shareholders will receive. This triggers more investors for your company ultimately aiding keep your company afloat within the market. What| is| Profitability| Analysis?| Definition| and| Importance

Returns on capital employed (ROCE) and Return on assets (ROA)

These returns measure the efficiency of a company in utilising of its assets. By evaluating ROCE, the management can take decisions that’ll help them minimise the inefficiencies. Higher the ROCE, higher will be the efficiency in the production process of the company. What| is| Profitability| Analysis?| Definition| and| Importance

ROA is a measure of every penny of income earned on every penny of the asset owned by the company. Similar to ROCE, ROA also helps the management manage the utilisation of assets, diligently.

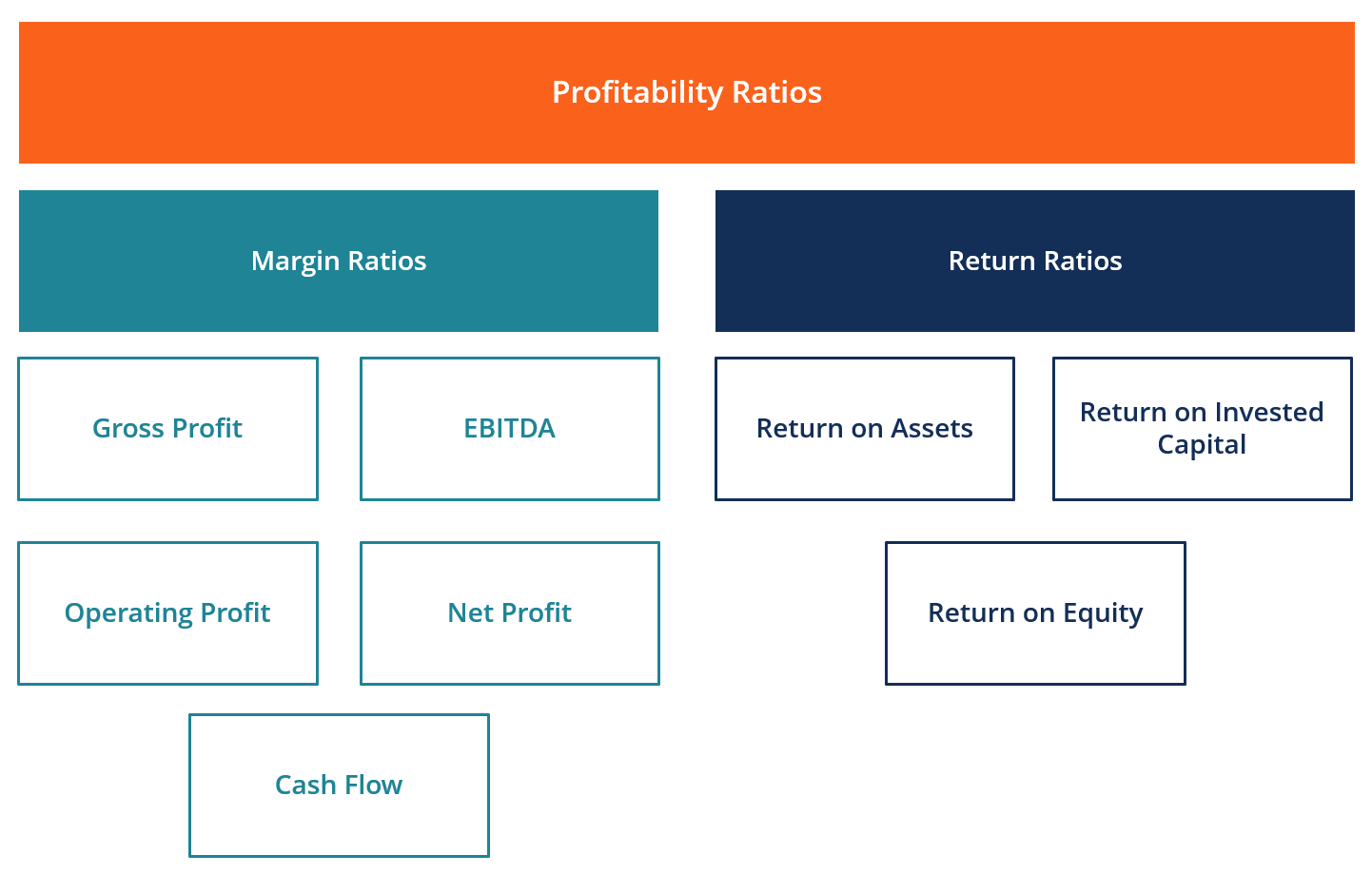

Profitability ratio analysis

Analysts and investors use profitability ratios to live and evaluate a company’s ability to get income (profit) relative to revenue, record assets, operating costs, and shareholders’ equity during a selected period of your time . They show how well a corporation utilises its assets to supply profit and value to shareholders.

A higher ratio establishes that the corporate is on the profitable side and is generating enough revenue, profit and income . This ratio analysis comes in handy while doing a comparative analysis together with your competitors within the market or maybe with previous periods, to know the present financial position of your firm.

Margin Ratios

To understand your company’s financial status during a selected period, it’s imperative to know your company’s ability to convert sales into profits. that’s what margin ratio represents at various degrees of measurement. a number of the examples are gross profit margin margin, operating margin of profit , net income margin, income margin, EBIT, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), NOPAT (Net Operating Profit After Tax), operating cost ratio, and overhead ratio

Return Ratios

As the name suggests, return ratio us nothing but the company’s ability to get returns to its shareholders. Examples include return on assets, return on equity, cash return on assets, return on debt, return on retained earnings, return on revenue, risk-adjusted return, return on invested capital, and return on capital employed. What| is| Profitability| Analysis?| Definition| and| Importance

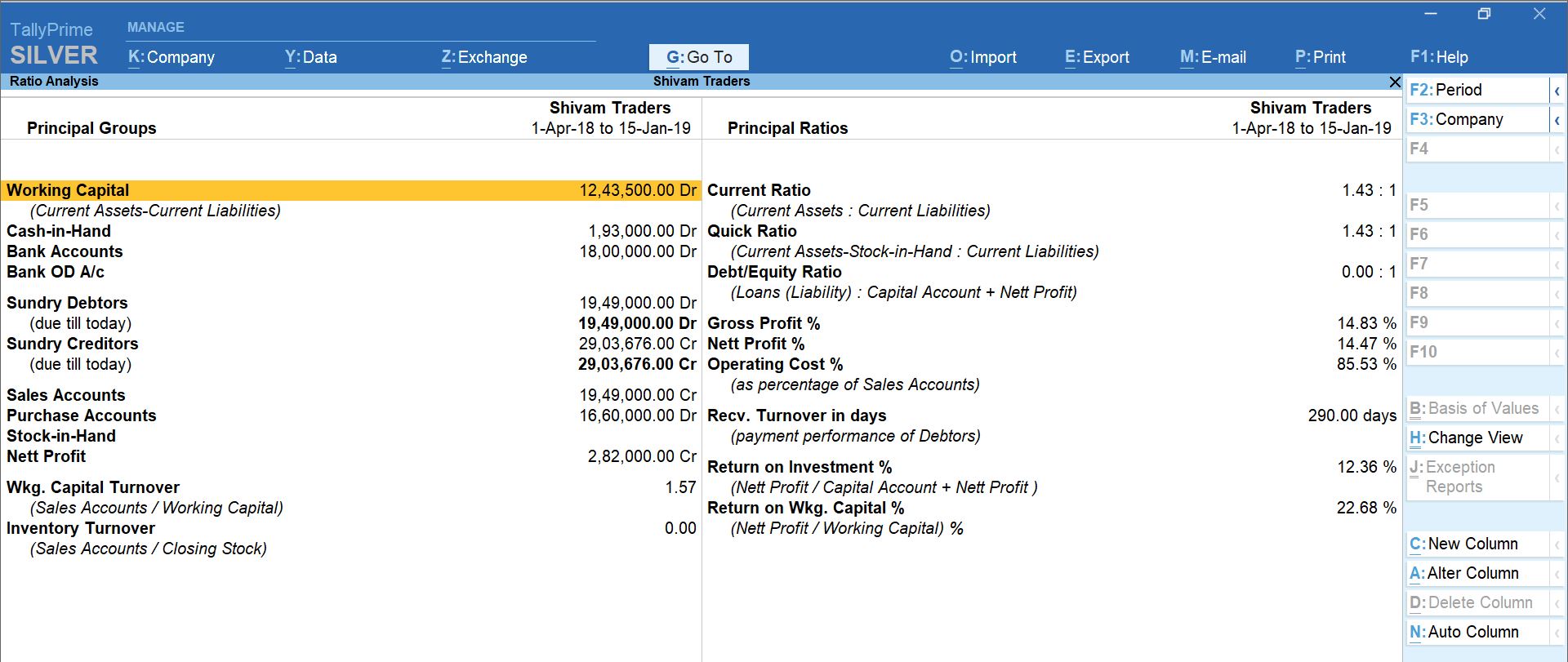

How TallyPrime helps in simplified analysis of profit ratios

With easy navigation of reports in TallyPrime, you’ll get a holistic deem well as you’ll dive deeper to seek out out the minutest details of the profits earned. The ratio analysis report is primarily divided into two parts, principal groups and principal ratios. The principal groups are the key figures that give perspective to the ratios. Principal ratios relate two pieces of monetary data to get a comparison that’s meaningful. you’ll simply select ‘Ratio Analysis’ on Gateway of Tally and you’ll see your financial statements at one shot for the chosen period. From gross profit margin percentage to knowing your returns on investments, every single detail is definitely accessible with the ratio analysis report.

You can even drill right down to each of the ratios to know their derivations and take decisions which will help improve your business efficiency. What| is| Profitability| Analysis?| Definition| and| Importance

| Are You Looking Forimportance of profitability? | |||||

| Are You Looking Forprofitability pdf? | |||||

| Are You Looking Forprofitability formula? | |||||

| Are You Looking Foroffshore manufacturing definition? | |||||

| Are You Looking Forprofitability analysis ppt? | |||||

| Are You Looking Forprofitability analysis methods? | |||||

| Are You Looking Forprofitability analysis in a sentence? | |||||

| Are You Looking Forprofitability analysis product wise? | |||||

| Are You Looking Forconduct profitability analysis? | |||||

| Are You Looking Forwhat is meant by measuring of profitability? | |||||

| Are You Looking Forprofitability definition? | |||||

| Are You Looking Forprofitability in a sentence? | |||||

| Are You Looking Forprofitability objectives? | |||||

| Are You Looking Forprofitability ratio formula? | |||||

| Are You Looking Forprofitability index example? | |||||

| Are You Looking Forconcept of capital rationing? | |||||

| Are You Looking Forprofitability index method is also known as? | |||||

| Are You Looking Forthe simplest capital budgeting technique is? | |||||

| Are You Looking Forlimitations of efficiency ratios? | |||||

| Are You Looking Forimportance of profitability ratio? | |||||

| Are You Looking Forlimitations of liquidity ratios? | |||||

| Are You Looking Forsignificance of solvency ratio? | |||||

| Are You Looking Forimportance of market ratio? | |||||

| Are You Looking Foruses of liquidity ratios? | |||||

| Are You Looking Forprofitability analysis report sample? | |||||

| Are You Looking Forbasic profitability analysis? | |||||

| Are You Looking Forcommon measure of profitability? | |||||

| Are You Looking Forwhat is customer profitability analysis? | |||||

| Are You Looking Forcustomer profitability in banking? | |||||

| Are You Looking Forhow to improve customer profitability? | |||||

| Are You Looking Forinsurance customer profitability? | |||||