Tally Solutions

What are the Key Reports a Business Owner Must Track 1 and Which is the Best Tool for it?

What are the Key Reports a Business Owner Must Track 1 and Which is the Best Tool for it?

As a business owner, you must be already keeping a track of the overall financial health of the business. While you may hire an accountant for end-to-end tasks that will keep your books of accounts updated, it is imperative that as a business owner, you also go beyond the basic understanding of key financial reports to take your business to the next level.

The three primary key aspects which would help you as a business owner to get a holistic view of your company’s books of accounts in sync with your business transactions are;

- Cash

- Stock and

- Taxation

Cash

What is the ultimate goal of any business? To have regular cash flow, right? So, where do we get these crucial insights about cash flow management in order to stay updated with your company’s finances from? Let’s take a look at how these cash flow reports will help you build your business and trigger long term, growth.

Cash Flow

Cash flow is the amount of money going in and out of your business. Healthy cash flow can help lead your business on a path to success. But poor or negative cash flow can increase risks to the future of your business. A cash flow projection estimates the money you expect to flow in and out of your business, including all your income and expenses. The main benefit of a cash flow forecast is that it lets you understand the impact of future and possible outcomes, plan for upcoming cash gaps, track whether spending is on target and manage surplus cash accurately. What are the Key Reports a Business Owner Must Track 1 and Which is the Best Tool for it?

Accounts Receivables and Payables

While managing accounts payable and accounts receivable is a bit of a juggle, it helps you get a thorough view of the cash inflow and outflow at a single shot. However, using accounts receivable and payable management software is like hiring the perfect employee who always follows your direction, never lets anything fall through the cracks, and works 24/7. When you fail to diligently manage your accounts receivable, you put your business in jeopardy. Effective management of accounts payable and receivable will increase the transparency of your books and sustain cash flow in your business. You can establish credit policies, manage outstanding bills, foster more communication and use automation to track the accounts accurately. This report is important not only for assessing overall performance but for helping managers and owners make smarter decisions that can influence an organization’s future. What are the Key Reports a Business Owner Must Track 1 and Which is the Best Tool for it?

Payment Performance of Debtors

Each firm has its own credit management policy based on which it decides to provide a timeframe for debtors to pay their dues. The formulation of debt management policy seeks to achieve a balance between extending sales and the likelihood of these sales being profitable and collectable. The key function of credit management is to optimise the sales at the minimum possible cost of credit. A payment performance report will help you understand and identify the customers who stick to the deadlines given to them by you which helps maintain a steady credit score. It also identifies and draws attention towards late payers on whom you can follow up appropriately. Defining credit policy through this report will enable business owners to define a “standard” model for stakeholders and customers that will further help you smoothen the process of debt collection and mitigating any risks which could affect your company’s financial status.

Stock

Stock or inventory are the most crucial aspects of many businesses. It is imperative to track their movement and shelf life in order to curb the losses which would be a result of stale stock. Tracking and keeping a close tab on the ageing stock has numerous benefits for a business. Stock reports enable business owners to make quick and informed decisions which will directly impact the growth and profitability of your business. What are the Key Reports a Business Owner Must Track 1 and Which is the Best Tool for it?

How Does Stock Ageing Analysis Affect the Growth of a Business?

- Understanding the duration of how long your products spend in inventory and compare performance against industry benchmarks.

- The inventory management approach used for each item type. With stock ageing analysis report, you can easily find out about the speed of every inventory’s movement.

- It may also include the time when an inventory arrived in the premises of each item including the delivery scheduling information, allowing you to focus your attention on the slowest moving items.

- Improving decision making on the timing and quantity of inventory purchases or production. What are the Key Reports a Business Owner Must Track 1 and Which is the Best Tool for it?

Since inventory is complex in nature, it is hard to generate reports and keep a track of the same on a regular basis without using the software. This will not only help businesses make informed decisions when it comes to purchases of the inventory but also enable businesses to draw a strategy to sell your products in the market accordingly. What are the Key Reports a Business Owner Must Track 1 and Which is the Best Tool for it?

How Stock-item Wise Profitability Will Give You an Overview of Your Business?

Profitability being the most important objective of any business, every entrepreneur needs a tool to help them assess the same. Stock-wise item profitability is one such way which enables the business owner to know the profitability of each item considering the cost and the price.

Which product is giving how much profit margin? How fast are items selling? Which products are making the most money? Such questions can be answered by your stock-item wise profitability report. What are the Key Reports a Business Owner Must Track 1 and Which is the Best Tool for it?

A stock-item wise profitability report will give a clear picture of how a particular item is performing in the market which will further give insights about the investment that needs to be made in that product. It also helps in making better buying decisions without having to put extra efforts to go through the marketing trends. What are the Key Reports a Business Owner Must Track 1 and Which is the Best Tool for it?

What Benefits Will an Entrepreneur Reap Out of Inventory Movement Analysis?

Movement analysis report is used for comparative studies. They give an insight into the flow characteristics of the stock in an organization. It also helps in finding out the slow-moving items which cause blockages in the flow of the working capital of the organization. What are the Key Reports a Business Owner Must Track 1 and Which is the Best Tool for it?

Keeping a close tab on the inventory will help business owners to take accurate and timely decisions about client requests and prospective projects. With an accurate inventory movement analysis report, business owners will get a clear picture of the amount of time a particular stock is spending time in the warehouse. What are the Key Reports a Business Owner Must Track 1 and Which is the Best Tool for it?

The shelf life of a stock helps assess the demand and supply of the same which further leads to quicker and smarter decision making for the entrepreneur. These reports help in getting real-time inventory visibility which records the data related to stock variance efficiently and makes necessary adjustments to generate an accurate view of stock levels.

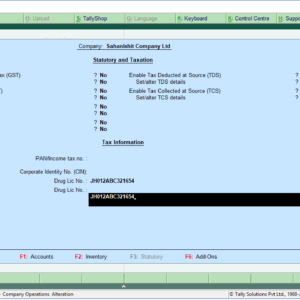

Taxation

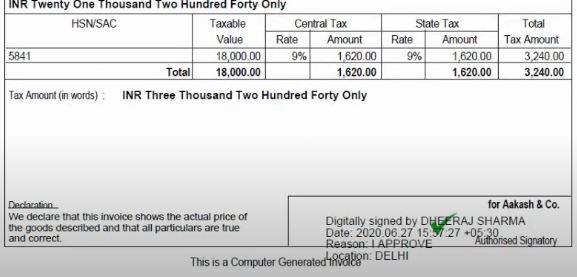

So, apart from keeping your books in sync with your business, what’s the next most crucial aspect you need to take care of as a business owner? GST! Yes, GST compliance is one of the most significant aspects in a business and recording business transactions adhering to the tax laws is extremely important to stay true to your business.

Did you know that one incorrect tax entry in your books could result in major errors and re-recording would obviously require additional time which is just not what you need, right? What are the Key Reports a Business Owner Must Track 1 and Which is the Best Tool for it?

How Would Seamless GST Recording Help Manage Businesses Efficiently

Being able to handle compliance seamlessly would enable easy management of financial data in GST regimes. By recording business data in GST compliant formats, you can file GST returns without any hassles or errors. It will also give your business an added advantage over your competitors. Here are some of the benefits of using GST compliant software What are the Key Reports a Business Owner Must Track 1 and Which is the Best Tool for it?

- Generate GST-Compliant invoices

- Last-minute filing can be avoided as the software will help you file your returns on-time with accuracy.

- Reconciliation of your books with the GST portal will no more be a cumbersome task as drawing comparisons can be done in a jiffy. Since the return filing process is via software, the reports will be error-free as the applicable taxes for specific goods will be done seamlessly.

- Get rightful input tax credit for your transactions

It is easy for anyone to get confused when it comes to choosing the right product for your business, as it’s difficult to find a single solution to all your accounting woes. Tally understands your business needs and provides all the solutions in a single software. You need not worry about your inventory, cashflow or compliance, for

Tally does everything for you at a flick so that your only focus is towards your business and increase your profitability. So, wait no more, and come and explore with Tally with a free trial and bid your worries goodbye! What are the Key Reports a Business Owner Must Track 1 and Which is the Best Tool for it?

CALL US FOR ANY QUERY WE ARE GLAD TO HELP YOU OUT @9811782542 & 9911721597| Are You Looking For tally | |||||

| Are You Looking For tally erp 9 | |||||

| Are You Looking For various types of reports generated in tally | |||||

| Are You Looking For tally result | |||||

| Are You Looking For types of key performance indicators | |||||

| Are You Looking For metrics reporting tools | |||||

| Are You Looking Forfree kpi monitoring tools | |||||

| Are You Looking For tally education | |||||

see our latest products