Uncategorized

How to Generate e-Invoice in GST?

How to Generate e-Invoice in GST?

The e-invoicing system proposed to be introduced on 1st October,2020 for business with an annual turnover of more than 500 crores, is primarily designed with 2 key aspects. First is the adoption of a standard for the invoice, which will enable standardization and swift data exchange across the different systems. The next being the registering the invoice with Government, through Invoice Registration Portal (IRP) which will ensure the authenticity of invoices.

At a larger picture, it is believed that the e-invoicing will play a key role to ensure interoperability of the data with various systems alongside curbing the tax evasion. How to Generate e-Invoice in GST?

With the implementation of e-invoicing, the GST system shall be able to validate all the B2B transactions electronically and pre-populate the same in taxpayer’s GST return forms and e-way bill, as per the details filled in the e-invoice by the taxpayer. How to Generate e-Invoice in GST?

Before getting into the process to generate e-invoice, it is important to note that there has been a major misconception surrounding the e-invoice generation. The famous misconception here is that business can generate the invoices centrally through governments portal. How to Generate e-Invoice in GST?

That’s not true! e-invoice does not mean the generation of invoices from a central portal of the tax department. Instead, e-invoice requires a business to generate the invoice in the prescribed format using the accounting software and upload it to the portal designed to authenticate such invoices. How to Generate e-Invoice in GST?

Let’s now understand the steps to generate the e-invoice

How to generate e-invoice?

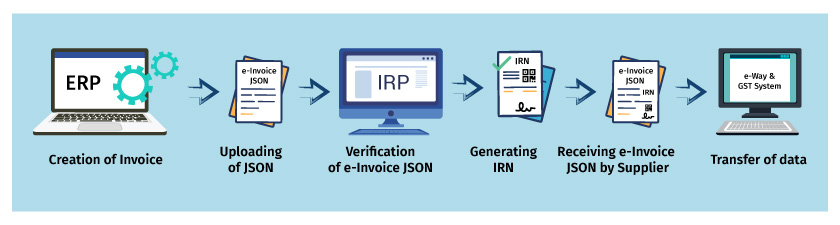

As illustrated above, the following are detailed steps to generate e-invoice in GST.

Step -1 Creation of e-invoice JSON:

The first step is to create the invoice JSON using the accounting software as per the prescribed format.

Step -2 Uploading of JSON:

In this step, the invoice JSON for every B2B invoice generated using accounting software or any other utilities are uploaded to the IRP system. How to Generate e-Invoice in GST?

Step-3 Verification of e-invoice JSON:

In this step, IRP system validates the e-invoice JSON and checks the central registry of GST for any duplication.

Step-4 Generating invoice reference number (IRN): After successful validation of e-invoice JSON, IRP system will generate IRN. IRN generated will be a unique number of each invoice for the entire financial year. Also, the e-invoice JSON will be updated with digital signature along with QR code.

Step-5: Receiving digitally singed e-invoice JSON: Here, the digitally signed e-invoice JSON along with QR code is sent to the supplier.

Step-6 Transfer of data to e-way bill system and GST system: The invoice JSON data uploaded, will be shared with the e- way bill and GST system, for preparing e – waybills and for auto-population of GST return.

- Part-A of e-way will be auto-populated with e-invoice data

-

Annexure-1 (outward supplies) and Annexure-2(Inward supplies) of New GST returns will be auto-populated with invoice JSON generated by IRP