Uncategorized

E-Invoicing Under GST 1

E-invoicing under GST – What is e-Invoicing? Applicability & Implementation Date

E-Invoicing in TallyPrime

e-Invoicing is a system that allows the Invoice Registration Portal (IRP) to authenticate B2B invoices electronically. Accordingly, TallyPrime is here to provide a smooth e-invoicing experience for you and your business. Once your e-invoice is ready, the details should be reflected in GSTR-1. E-Invoicing Under GST

The GST Council, in its 39th meeting, has decided to implement a system of e-invoicing, which will be applicable to businesses having a turnover of more than 500 crores, effective from 1st October 2020, and to businesses having a turnover of more than 100 crores, effective from January 1, 2021. Accordingly, TallyPrime’s e-invoice solution can be used by taxpayers, tax consultants, and other eligible entities. The experience is simple and is based on regular invoicing activity that does not require any special expertise. E-Invoicing Under GST

For example, if you use TallyPrime, then you only have to record your sales transactions as usual, and your e-invoice requirement will be covered in the same flow! Important details, such as IRN, Ack No., QR code, and e-Way Bill no., will be updated in the vouchers automatically, and you can proceed to print them. Moreover, TallyPrime will ensure that both your business accounts and compliance requirements are suitably addressed. E-Invoicing Under GST

TallyPrime also provides you with the flexibility to generate e-invoice in bulk for multiple invoices. If you do not want to generate the e-invoice while recording the transaction, then you can select one or more transactions from the e-Invoice report and generate the respective IRN, at your convenience.

We understand how valuable your data is for you and your business, and we have provided various measures in TallyPrime to safeguard your data. All the requests for online e-invoicing will pass through Tally GSP (TIPL), which has been awarded ISO 27001:2013 certificate for its stringent security policies. The best part is that you will not need any additional software or plugins to enjoy the benefits of e-invoicing in TallyPrime.

E-Invoicing Under GST

Some of the key benefits are:

- One-time reporting of the invoicing details for all your GST filings

- Seamless generation of E-way Bill with Part A and Part B slip

- The standard invoicing system means interoperability between multiple software

- Real-time tracking of invoices prepared by the supplier

- Minimized invoice mismatches during reconciliation

- Easy and Precise ITC claim

What is E-invoicing and an e-invoice under GST?

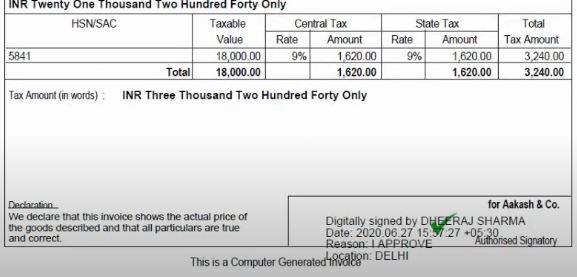

E-invoicing aka Electronic Invoicing is an electronic authentication mechanism under GST. Under the mechanism, all the B2B and Export invoices generated by a business need to be registered with the Government system i.e. the Invoice Registration Portal (IRP) and obtain a unique identification number for every invoice called Invoice Reference Number (IRN). Along with IRN, the IRP will also create a digitally signed QR code with select details from invoice and digitally sign the uploaded invoice data.

Thus, an e-invoice is a document which has an IRN associated with it and the digitally signed QR code printed on it.

Who needs to generate an E-Invoice?

On the basis of Aggregate Annual Turnover (AATO):

E-Invoice has been introduced in the country in a phased manner based on the Aggregate Annual TurnOver of the companies. The first phase went LIVE for companies with turnover more than Rs.500 CR on 1st October 2020. The second phase went LIVE for companies with turnover more than Rs.100CR on 1st January 2021. The third phase is supposed to go LIVE from 1st April 2021 for companies with Rs 50 CR and above turnover.

Section 2(6) of the CGST Act: “(6) “aggregate turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess; “

What software/application can be used to generate an E-invoice under GST?

As opposed to the contemporary belief that an E-invoice has to be generated on the common portal, an E-invoice can be generated through any software/tool that supports the givenIt is important to prepare the system to send and receive invoice data.

It is important to note that the invoice generation will continue to be done by taxpayers. For generating IRN, taxpayers can opt for solutions which can be embedded in their current invoicing processes or use manual generation options. However, there are many tasks post IRN generation i.e. getting invoice printed with QR code, checking its auto-population in GSTR 1 etc. and hence it is recommended to choose a solution which can provide for all needs around e-invoicing and GST compliance.

IRIS Onyx – is a complete e-invoicing software solution that can help you make your e-invoicing journey a smooth ride.It is a cloud-based advanced e-invoicing solution that can integrate with your billing systems in multiple ways and help you generate IRN seamlessly without disrupting your current business processes.