Webtel E – Invoicing Solution (5 Node multi user)

₹8,950.00 Inclusive of taxes

Challenges – Post E-Invoicing

- Mapping of invoice fields as per standard prescribed by GSTN.

- Invoice data to be pushed from Accounting/ERP in JSON format to IRP.

- IRN generated by IRP to be pushed to Accounting/ERP for printing on invoice.

- Invoice cancellation/modification on IRP/GST portal.

-

Timeline for GST E-Invoicing

Turnover Date Status Above 500 cr Jan1, 2020 B2B E-invoice Optional 100-500 cr Feb1, 2020 B2B E-invoice Optional Above 100 cr Oct1, 2020 B2B E-invoice Mandatory Above 500 cr Oct1, 2020 B2C Invoice with QR Code Mandatory Call us if you have any query, @ +91-9911721597,7838541297 or email us at support@dssoftweb.com

Category: Webtel Software

Webtel E – Invoicing Solution (5 Node multi user)

Solution to Overcome the Challenges

- Webtel to provide connector/integration services to fetch invoice data from accounting package.

- Webtel to generate JSON of invoice and upload it to invoice Reporting Portal (IRP) through its GSP services.

- IRN obtained from IRP to be pushed to ERP/Accounting.

- Utility to Validate GSTIN of Suppliers.

- Auto import of inward/outward supplies data from Company’s ERP through Connectors.

- Preparation of RET-1 (POST ‘e’ INVOICING).

-

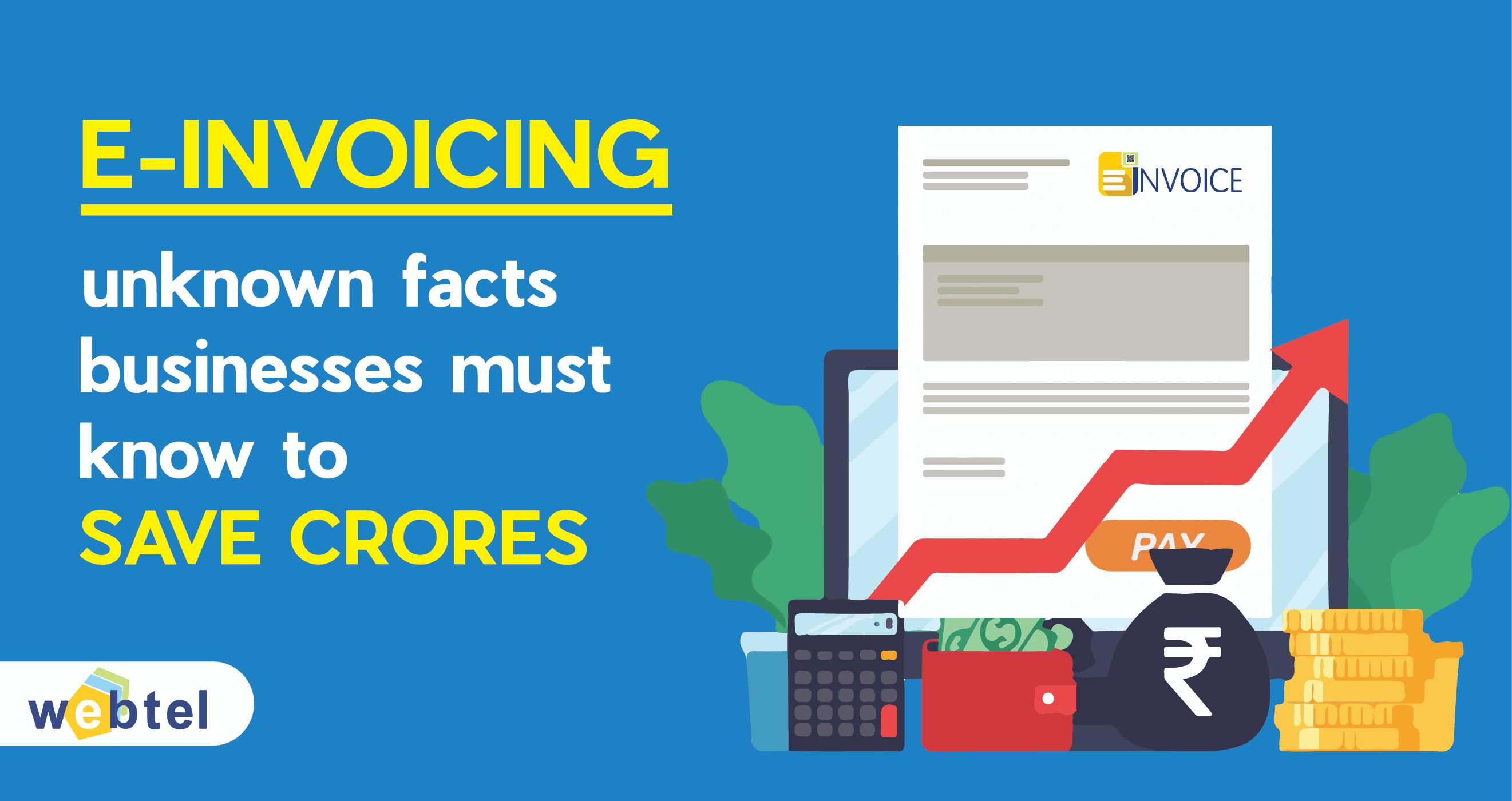

Even though there are lots of issues and concerns around the e-Invoicing system, no one can ignore the fact that implementing the e-Invoicing system could save money for your organization.

Want to know how?

Then here are the top 10 hidden facts about it that everyone might have missed but should know to get maximum monetary benefits from it. So have a look at these points, enrich your knowledge, save yourself from penalties & make money.

Webtel E – Invoicing Solution (5 Node multi user)

#1 e-Invoicing brings Transparency

e-Invoicing system brings more transparency in reporting of invoices as only valid or authenticated invoices with IRN shall be uploaded and no fake or bogus invoices.#2 Claiming Accurate ITC

Since no invoice will be hidden or missed from the system, the reconciliation will be thorough and detailed that helps taxpayers in claiming accurate and maximum ITC.#3 Unique QR Code and IRN Use

QR code and IRN are the main essences in e-Invoicing. IRN proves the invoice’s authenticity and a QR code are used to quickly access the same invoice details or information. For example, when a supplier supplies the goods or services to the recipient, the recipient only needs to scan the QR code to the QR code scanner and the recipient is able to see all the relevant details of that invoice in their system#4 Real-Time Tracking

Invoices reported in the e-invoice process on a real-time basis. So the taxpayers have the information for ITC claiming and return filling.#5 Auto-population of Data

e-Invoicing helps in the auto-population of data in the system of GST. The e-invoice data helps in auto-population of Part-A of e-Way Bill, and also in GST returns, resulting in avoidance of manual entries.#6 e-Invoicing Partially Eliminates the Manual Work

Implementing e-Invoicing system eliminates the use of paper invoices. Currently the manual work is partially eliminated, as B2C invoices and businesses with turnover less than Rs. 100 Crores shall continue using paper invoices. The elimination of the paper use also eliminates its cost, other related costs, and the trouble of handling and transferring paper invoices.#7 Reduction in Human Errors

As the e-Invoicing process is automated, it reduces the human intervention in the form of data entry. The reduced human work shall ultimately reduce the errors. This overall process brings more accuracy in the e-Way Bills, Invoice generation, and GST filing.#8 Transparency for Tax Officials

e-Invoicing made it easier for the Tax officials to access the e-invoice data whenever they need it. This creates more transparency in the availability and accessibility of invoice data for both taxpayers and tax officials.#9 Less Notice to Taxpayers from Department

e-Invoicing made it easier for the Tax officials to access the e-invoice data whenever they need it. This creates more transparency in the availability and accessibility of invoice data for both taxpayers and tax officials.#10 Savior for Working Capital

e-Invoicing is not just the smooth functioning of the invoice process but also the ultimate savior of working capital. The working capital can be saved by receiving fewer notices resulting in avoidance of penalties, legal cost, and reduced audits. e-Invoicing makes reconciliation of data and ITC availability easier and clear, hence saving the businesses from paying more than their actual liability.Implementing an e-Invoicing system is highly beneficial for any business. It makes the maximum use of an IT infrastructure and supports the digitalization of the economy. By complying wisely, organizations not just saves money but also adds more value with less trouble.Good Luck and Happy e-Invoicing 🙂

Call us if you have any query, And for free demo @ +91-9911721597,7838541297 or email us at support@dssoftweb.com

Material

hide

Only logged in customers who have purchased this product may leave a review.

Related products

Webtel Software

Webtel WEB-E-PAYROLL Rolling in the Payroll system (Single User)

₹4,450.00 Inclusive of taxes

₹4,450.00 Inclusive of taxes

Webtel Software

₹4,450.00 Inclusive of taxes

₹8,950.00 Inclusive of taxes

₹8,950.00 Inclusive of taxes

₹8,950.00 Inclusive of taxes

Webtel Software

Webtel WEB-e-TAX ( Your Returns….. we take care (Single user)

₹4,450.00 Inclusive of taxes

₹8,950.00 Inclusive of taxes

Reviews

There are no reviews yet.