marg-erp-9-accounting-software-silver-edition

₹14,868.00 Original price was: ₹14,868.00.₹13,379.00Current price is: ₹13,379.00. Inclusive of taxes

| • | Multi companies | |

| • | Multi locations (godowns) | |

| • | Multi currency | |

| • | 7 layer backup protection | |

| • | Multiple Bank Account Management. | |

| • | Advance Payment Scheduling. | |

| • | Serving Different Trade Segments Competently. | |

| • | Eliminate mismatch conditions when uploading and downloading invoices. | |

| • | Individuals having multiple business verticals can benefit from GST compliances. | |

| • | . Interconnected business applications can manage enterprise and automating back-end business functions with ease. | |

| • | . Control multiple branches from a single control center. | |

| Call us if you have any query, @ +91-9911721597,7838541297 | ||

| or email us at support@dssoftweb.com | ||

marg-erp-9-accounting-software-silver-edition

Basic of GST

GST (Goods and Services Tax) as the name suggests is a Single, Comprehensive Indirect Tax levy on manufacture, sale and consumption of goods and services at a National level.It is a tax on goods and services with value addition

marg-erp-9-accounting-software-silver-edition

GST Composition Schemehttps://onlineretailhub.in/

Composition is a method of levy of taxes designed for small taxpayers whose turnover is up to Rs. 75 lakhs ( Rs. 50 lakhs in case of few States). The aim of composition scheme is to bring simplicity

marg-erp-9-accounting-software-silver-edition

GST Reverse Charge

The supplier of Goods generally pays the Tax on supply but on occasion when the reciever/purchaser becomes liable to pay taxes, such a condition is termed as reverse charge. The concept of reverse charge under GST came into force to increase tax compliance and tax revenues.

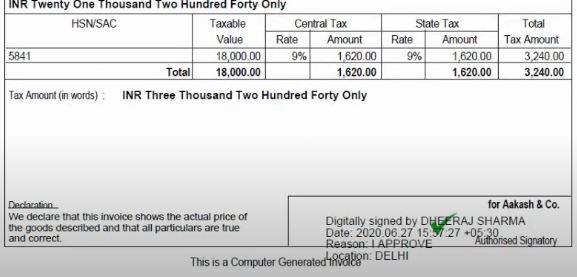

GST Invoice

An invoice or a Bill could be defined as a list of goods sent or services provided, along with the amount due for payment. GST compliant invoices can be made with Marg ERP 9+ Software.

An invoice or a Bill could be defined as a list of goods sent or services provided, along with the amount due for payment. GST compliant invoices can be made with Marg ERP 9+ Software.For all the businesses which are GST registered they need to provide GST-complaint invoices to their clients for sale of goods and/or services. All the GST registered vendors provide GST-compliant purchase invoices to you.

Mandatory fields under GST invoice

The GST invoice is issued to charge the tax and pass on the input tax credit. Some of the mandatory fields under GST invoice are

- Invoice number and date

- Customer name

- Shipping and billing address

- taxpayer’s GSTIN

- Place of supply

- HSN/ SAC code

- Item details i.e. Quantity (number), unit (metre, kg etc.) and total value

- The Taxable value and discounts

- Rate and amount of taxes i.e. CGST/ SGST/ IGST

- Whether GST is payable on reverse charge basis

- Signature of the supplier

Time Limits to issue GST tax invoice

In Marg, you can see all sales reports through gross profit by the help of which you come to know all details regarding profits or losses area, route, salesman, party, company, item, etc wise. Readmore

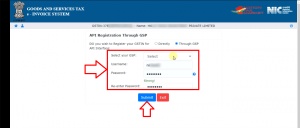

- As the user will tick the circle of ‘Through GSP API Interface’; some fields i.e. ‘Select your GSP, Username, Password, Re-enter Password’ will appear.

- The user will fill all these fields as per the requirement.http://dssoftweb.com/

- Then click on ‘Submit’ tab.

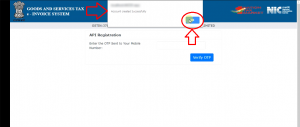

- The user will receive an ‘OTP’ on the registered mobile number.

- The user will fill that OTP and click on ‘Verify OTP’.

- A pop of message of ‘Account Created Successfully’ will appear.

- The user will click on ‘OK’.

- So, in this way the process of the portal will get completed.

PROCESS OF E-INVOICING IN MARG ERP SOFTWARE

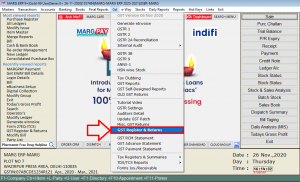

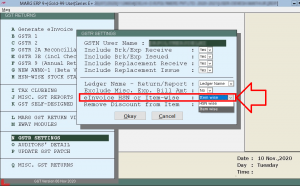

- Go to GST >> GST Register & Returns.

- Click on ‘GSTR Settings’.

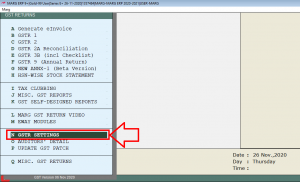

-

- A ‘GSTR Settings’ window will appear with different fields.

- The user will go to ‘eInvoice HSN or Item Wise’ field. Select as per the requirement that whether the invoices which are required to be uploaded on eInvoice Portal should be uploaded HSN Wise or Item Wise.

Suppose, select ‘Item Wise’.

- In ‘Remove Discount from Item’ field, if the user keeps a discount on an item then it sometimes creates an issue in discount which is being provided after applying tax at the time of uploading invoice due to which the user will not be able to successfully upload the invoice on e-Invoice Portal.

Management Utilities

In Marg, there is provision of bulk updation or deletion.

- Delete Special Rates, Deals & Discount in single button Company Special,Special Note on Invoice, Heading of Invoice.

- Multi Deletion of Non working Items & Ledger, Printer Port, Bill Headings, Formats, Ledger Transactions, Import Data, Closing/Opening Balances, etc

- Multi Editing Item, Party, Company, Credit Limit, Auto Fix Credit Limit, Party Area / Rout / MR, Voucher Remarks, Old Discount % to New Discount %, Old Tax % to New Tax %, Tax of old bills, Re-arrange Bill No/Receipt No/Retail-Tax invoice headings, etc.

-

Distribution of ERP Software

It is one of the most important aspects of your business that can gain a lot of benefits from the ERP system. It can monitor supply chains, orders, and track the movement of materials. In the end, distribution becomes even more effective. You can keep track of supply chains, orders, and status of materials with Marg ERP software. It can optimize the distribution process and positively impact sales, customer service, inventory, etc. Since distribution lies in the heart of other processes and connects both customers and manufacturers, your system should be able to connect distribution to various business areas and you can gain a better insight. It gives details on the influence of the backend and frontend on distribution.

Here’s How an ERP System Can Help in Distribution –

- Order management and monitoring

- Front counter operations

- Accounts receivables report

- Automated ledgers

- Keeping track of schedules of customer delivery

- Order return processing

- Picking and slotting analysis

If the distribution is all your business depends on, you should have a robust ERP system that is tailored strictly for it. You can gather information from several departments by having a cloud-based system.

Inventory

It is another important aspect of your distribution channel. You can use an ERP system to control all your inventory levels. Whether you have an unused inventory issue or you can’t maintain stock of some items, ERP systems can help fix these problems. Here are some of the features of ERP related to inventory management –

- Real-time inventory check

- Warehouse management

- Purchase data

- Inventory orders

- Material tracking

- Forecasts inventory adjustments

- Storage availability

You can see the factors affecting inventory management by analyzing information in all the processes.

There is a specific time limit to issue GST tax invoices, revised bills, debit note and credit note. The due dates for issuing an invoice for goods in normal case is on or before date of removal of delivery. And in case of continuous supply of goods it is on or before the date of issue of account statement. The Time limit in case of normal services is within 30 days of supply of services

Call us if you have any query for free demo @ +91-9911721597,7838541297or email us at support@dssoftweb.com

| Shop by Brand | Marg Softwares |

|---|---|

| Shop by Category | Accounting Software's |

Only logged in customers who have purchased this product may leave a review.

Related products

Softwares

Softwares

Marg ERP 9 Softwares

Anti Virus

Softwares

Reviews

There are no reviews yet.