ALL IN ONE TDL FOR TALLY ERP 9

₹10,000.00 Original price was: ₹10,000.00.₹3,500.00Current price is: ₹3,500.00. Inclusive of taxes

Step 1. Go to Gateway of Tally.

Step 2. Then Press Ctrl+Alt+T button

Step 3. Now Press F4 Button or Click on “Manage Local TDL” button

Step 4. Now do “Yes” to “Loan TDL Files on Startup” option

Step 5. Now in the next line “List of TDL Files to preload on Startup” Enter the TDL File Path or Location Like “E:File.tdl”

Step 6. Now save the settings

| Call us if you have any query, @ +91-9911721597,7838541297 | ||

| or email us at support@dssoftweb.com | ||

ALL IN ONE TDL FOR TALLY ERP 9

Add on in Tallyhttps://onlineretailhub.in/

Add-ons in Tally is nothing but products that Tally offers for it’s customers through its centralized location that has a host of generic add ons (customised programs/extensions). Tally Add ons are developed by authorised Tally partners and available in Tally Shop.

Interested customers can access Tally Shop, search for the required solution, download and use them by paying the requisite price or subscription charges.

ALL IN ONE TDL FOR TALLY ERP 9

How to enable Tally.ERP 9 add on?

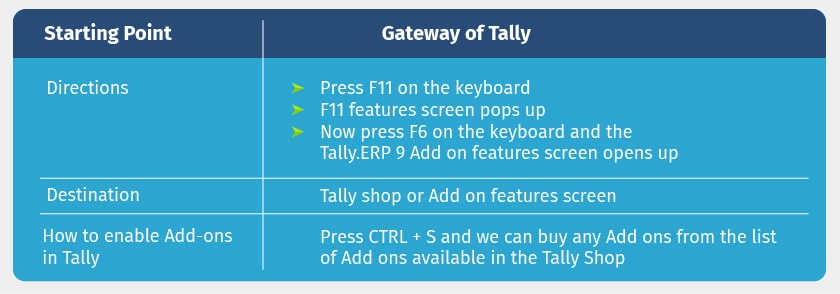

The Tally map is here to help you guide through the Tally Shop. To enable Tally Add ons just follow the given direction.

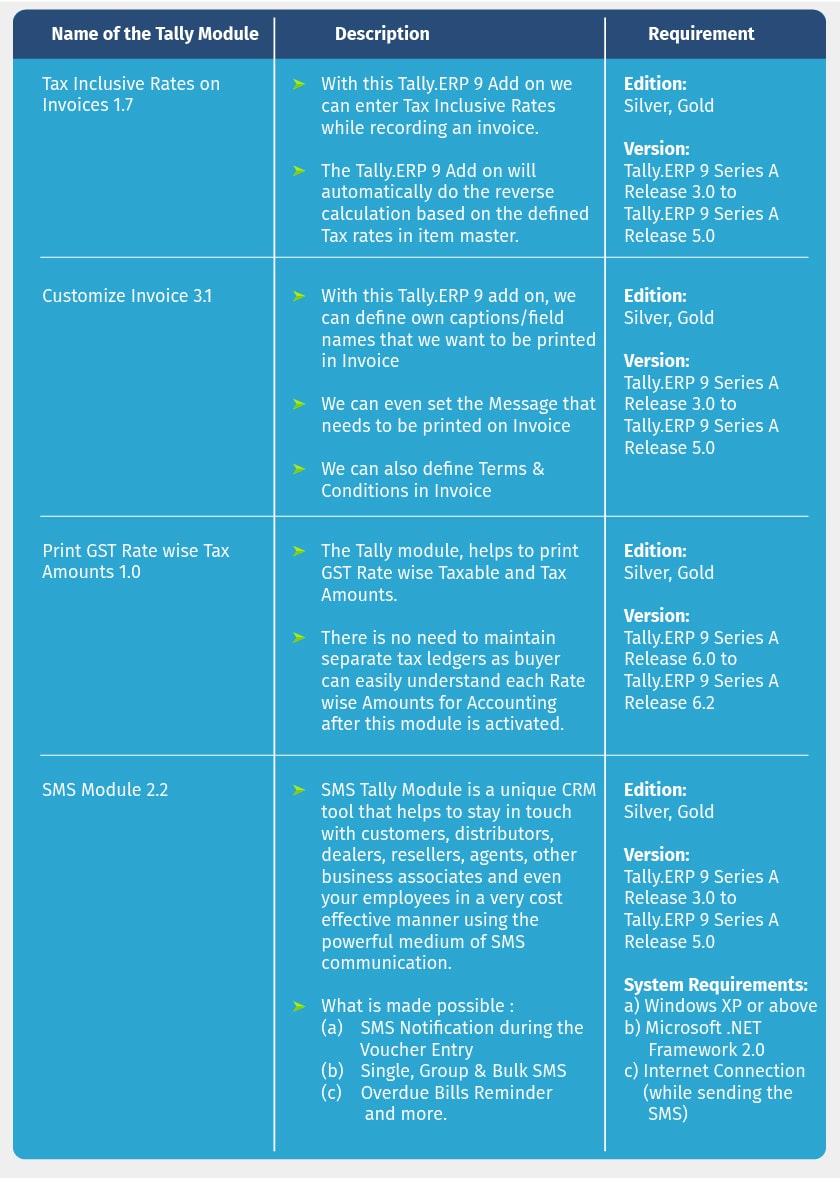

List of few Tally modules which one can purchase from Tally shop

ALL IN ONE TDL FOR TALLY ERP 9

Best Practices to Evaluate, Purchase and Implement Business Accounting Software

5 Tips to Keep your Business Accounting Organized

Generate e-Invoice Instantly in TallyPrime

Bulk Generation of e-Invoices in TallyPrime

e-Invoice from 1st January 2021http://dssoftweb.com/

Business Impact of e-Invoice: What will Change?

We understand that this is a completely new experience and you will take time to get used to it. Moreover, you may be faced with different situations while needing to comply with e-invoicing norms. TallyPrime has therefore made the product extremely flexible so that the process is convenient and adapts to your comfort.

- You can either generate e-invoice during voucher entry for a transaction or you could do this in bulk for multiple invoices together. TallyPrime will adapt to your preference

- It is quite possible that the system you normally use to generate e-invoice may get disconnected from the internet. In such a case, TallyPrime will help you handle the situation by exporting e-invoice related data in the form of a JSON file. This can then be uploaded to the IRP from a system which has an internet connection. Once connection is restored, you will be able to proceed from where you left off

- Even if the IRP rejects your invoice, TallyPrime will intimate you about the reasons so that you can make necessary revisions and try again.

e-Invoice report to get a bird’s-eye view

Simple to use

An accounting software should ideally be usable even by a person who does not have a background in accounting. As a business owner, you shouldn’t have to depend upon your accounts team to keep a track of your business transactions and important financial reports. It is important to identify a software that helps you do your business better rather than one that requires you to change the way you do business. An ideal accounting software should be simple and easy to use, while, at the same time, giving you the flexibility to manage the different kinds of transactions that you deal with in your business.

Prevention and detection of errors

A key reason for using an accounting software as opposed to performing accounting tasks manually is to minimize errors in accounting. The accounting software that you select should, firstly, prevent you from making errors by enabling you to pre-set majority of the details required in a transaction. Automatic calculations are also a feature which help you to avoid making errors. Another important ability that you should look for is detection of errors. An accounting software should be able to detect the kind of errors that are dynamic and cannot be avoided by settings. An example can be alerts when you are trying to make a sale of an item which is not in stock at that time. Detection of errors in such cases will help you avoid larger mistakes and ensure credibility in front of your customers and suppliers. Prevention and detection of errors is an important feature to look for in an accounting software.

Sync your invoicing, accounting and inventory management

Invoicing, accounting and inventory management are inter-related tasks. An accounting software should have the capability to sync your invoicing, accounting and inventory data and present you with a consolidated view of your business. Ideally, the only ‘input’ that you would need to give to the accounting software should be the invoice or transaction for your business. Based on this, your accounts and inventory should be automatically updated. This helps to save a lot of time and effort which might otherwise be required for this process and helps you in quick decision-making.

Reconcile transactions with banks, suppliers and customers

A business needs to continuously reconcile its transactions with various stakeholders, such as banks, suppliers and customers. Bank reconciliation or reconciling your books with your bank statements is a very important accounting activity. Similarly, credit management is another important activity for every business. Under credit management, you need to be aware about the money you owe your suppliers and the respective due dates as well as the money your customers owe you, along with their due dates. You can read more about the importance of credit management in our article ‘Importance of credit management’ . Ideally, since bank reconciliation and credit management are important accounting activities, your accounting software should be able to perform these with ease.

TallyPrime also comes with an exclusive report which will give you a complete view of the status of your transactions with respect to e-invoicing.

- Get to know the e-invoice status (generated / pending / cancelled)

- Generate / cancel IRN for applicable invoices

- Manually override status of invoices (generated / cancelled

| Call us if you have any query, @ +91-9911721597,7838541297 | ||

| or email us at support@dssoftweb.com | ||

Only logged in customers who have purchased this product may leave a review.

Related products

Softwares

Business Productivity

Anti Virus

Busy Softwares

Reviews

There are no reviews yet.