Your cart is currently empty!

MARG ERP 9+ Inventory & Accounting Software- Basic (CD)

Product Features • Multi companies • Multi locations (godowns) • Multi currency • 7 layer backup protection • Multiple Bank Account Management. • Advance Payment Scheduling. • Serving Different Trade Segments Competently. • Eliminate mismatch conditions when uploading and downloading invoices. • Individuals having multiple business verticals can benefit from GST compliances. • . Interconnected business applications can manage enterprise and automating back-end business functions with ease. • . Control multiple branches from a single control center. Call us if you have any query, @ +91-9911721597 or email us at support@dssoftweb.com

Description

Product Description

MARG ERP 9+ Inventory & Accounting Software- Basic (CD)

- PURCHASE IMPORT + MY ORDER TO BILL + EXPORT IN SELF FORMAT This option is used to import purchase invoice from CSV, EXCEL, XML, DBF, TXT formats etc… Even you can define import method from CSV, EXCEL, XML, DBF, TXT formats etc… You can also define import data on the bases of Starting Line, Data Format, From Line, Starting and Ending string option during import method. After this option you don’t have to feed manual purchase. It will save your time with 100% accuracy.

- DATA IMPORT & EXPORT Marg Software have a unique feature to convert the Tally software data in Marg Software. Marg software data will also be converted into the Tally. The main objective of this option is that if your CA is using the Tally Software and he wants the data of your firm in Tally software but you are using the Marg Software to maintain your Accounts & Inventory.

- SALES BILL ATTRACTION In Marg, billing system is very much advanced yet easy to use. In our views, customer spend more time on their billing so that we are always focused on the ways through which you can do your billing with the less use of enter key. Cash/Credit Management, Challan/Order Loading, Item Searching, Real Time with Live Balances on Multi-user, Light Fluctuation Security options etc are incomparable.

- INVOICING : VAT Invoicing (Tax / Retail), Multiple Taxes in Single Invoice, Tax Inclusive / MRP Billing, Fully User-Configurable Invoicing

- BILL AUDIT DISPATCH MANAGEMENT SYSTEM Free Installation support from Oyster Infomedia labs and Extra Charges for Implementation of this software.

-

marg-erp-9-accounting-software-silver-edition

GST Composition Schemehttps://onlineretailhub.in/

Composition is a method of levy of taxes designed for small taxpayers whose turnover is up to Rs. 75 lakhs ( Rs. 50 lakhs in case of few States). The aim of composition scheme is to bring simplicity

marg-erp-9-accounting-software-silver-edition

GST Reverse Charge

The supplier of Goods generally pays the Tax on supply but on occasion when the reciever/purchaser becomes liable to pay taxes, such a condition is termed as reverse charge. The concept of reverse charge under GST came into force to increase tax compliance and tax revenues.

GST Invoice

An invoice or a Bill could be defined as a list of goods sent or services provided, along with the amount due for payment. GST compliant invoices can be made with Marg ERP 9+ Software.

An invoice or a Bill could be defined as a list of goods sent or services provided, along with the amount due for payment. GST compliant invoices can be made with Marg ERP 9+ Software.For all the businesses which are GST registered they need to provide GST-complaint invoices to their clients for sale of goods and/or services. All the GST registered vendors provide GST-compliant purchase invoices to you.

Mandatory fields under GST invoice

The GST invoice is issued to charge the tax and pass on the input tax credit. Some of the mandatory fields under GST invoice are

- Invoice number and date

- Customer name

- Shipping and billing address

- taxpayer’s GSTIN

- Place of supply

- HSN/ SAC code

- Item details i.e. Quantity (number), unit (metre, kg etc.) and total value

- The Taxable value and discounts

- Rate and amount of taxes i.e. CGST/ SGST/ IGST

- Whether GST is payable on reverse charge basis

- Signature of the supplier

Time Limits to issue GST tax invoice

In Marg, you can see all sales reports through gross profit by the help of which you come to know all details regarding profits or losses area, route, salesman, party, company, item, etc wise. Readmore

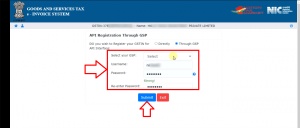

- As the user will tick the circle of ‘Through GSP API Interface’; some fields i.e. ‘Select your GSP, Username, Password, Re-enter Password’ will appear.

- The user will fill all these fields as per the requirement.http://dssoftweb.com/

- Then click on ‘Submit’ tab.

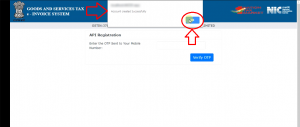

- The user will receive an ‘OTP’ on the registered mobile number.

- The user will fill that OTP and click on ‘Verify OTP’.

- A pop of message of ‘Account Created Successfully’ will appear.

- The user will click on ‘OK’.

- So, in this way the process of the portal will get completed.

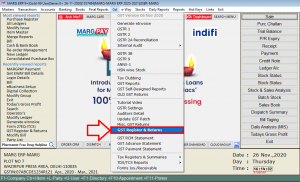

PROCESS OF E-INVOICING IN MARG ERP SOFTWARE

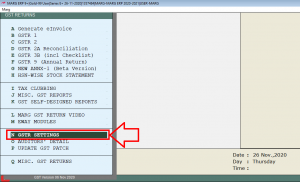

- Go to GST >> GST Register & Returns.

- Click on ‘GSTR Settings’.

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.